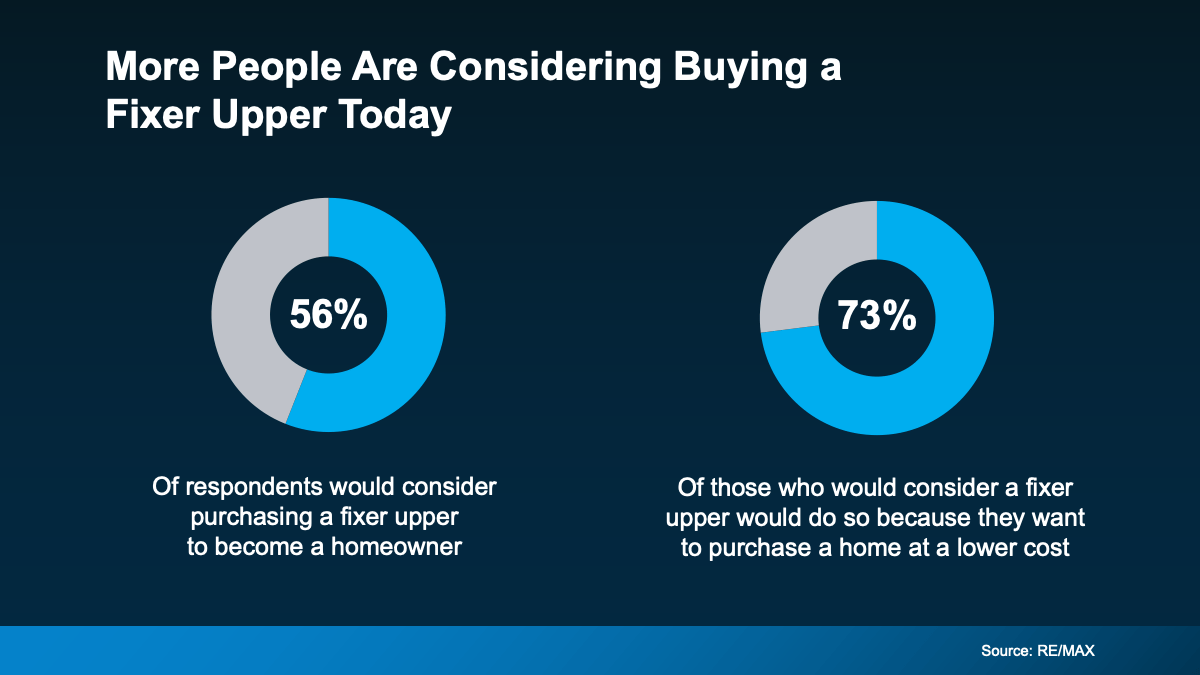

In Connecticut’s competitive housing market, particularly in Fairfield and New Haven Counties, purchasing a fixer-upper can be a strategic way to achieve homeownership. By investing in a property that requires some renovation, you can enter desirable neighborhoods at a more affordable price point and customize your home to your preferences.

Understanding Fixer-Uppers

A fixer-upper is a property that, while livable, needs varying degrees of renovation. This can range from cosmetic updates like painting and flooring to more extensive work such as roof replacement or plumbing upgrades. These homes typically have a lower purchase price compared to move-in-ready properties, offering potential savings for buyers willing to invest time and resources into improvements.

Local Market Insights

In towns like Monroe, Shelton, Newtown, Trumbull, Milford, Oxford, Seymour, Orange, Stratford, Bridgeport, Brookfield, and Southbury, the real estate market reflects a range of home values:

- Trumbull: The average home value is approximately $610,727, reflecting an 11.9% increase over the past year.

- Newtown: The median sale price is around $547,500, though this represents a 33.6% decrease compared to the previous year.

- Monroe: Recently sold homes had a median listing price of $449,450, with properties spending an average of 38 days on the market.

- Shelton: The average home value is approximately $513,477.

- Milford: The average home value is approximately $478,898, up 10.1% over the past year.

- Stratford: The average home value is approximately $426,770, up 10.1% over the past year.

These figures indicate that purchasing a fixer-upper in these areas can provide significant savings compared to move-in-ready homes, especially considering the potential for property value appreciation after renovations.

Key Considerations When Buying a Fixer-Upper

- Location Matters: While you can renovate a house, you can’t change its location. Choose a neighborhood with strong property value trends and desirable amenities to ensure your investment grows over time.

- Budget for the Unexpected: Renovations often come with unforeseen expenses. Allocate extra funds to cover unexpected repairs or delays to keep your project on track.

- Professional Home Inspection: Hire a qualified inspector to assess the property’s condition thoroughly. This step can uncover potential issues that may affect your renovation plans and budget.

- Prioritize Renovations: Categorize your projects into essential repairs, desirable upgrades, and future enhancements. This approach helps manage your budget and ensures that critical issues are addressed first.

Leveraging Local Expertise

As a REALTOR® with extensive experience in Fairfield and New Haven Counties, I can guide you through the process of identifying fixer-upper opportunities that align with your goals. My knowledge of the local market trends and property values enables me to help you make informed decisions and maximize your investment.

Conclusion

Purchasing a fixer-upper in Connecticut’s dynamic real estate market offers a pathway to homeownership that combines affordability with the potential for significant value appreciation. With careful planning, budgeting, and the right professional guidance, you can transform a property in need of TLC into your dream home.

If you’re ready to explore fixer-upper opportunities in Monroe, Shelton, Newtown, Trumbull, Milford, Oxford, Seymour, Orange, Stratford, Bridgeport, Brookfield, Southbury, or surrounding areas, feel free to reach out. Together, we can find a property that meets your needs and sets you on the path to successful homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link